General Laws of Massachusetts - Chapter 175 Insurance - Section 9 Computation of reserve liability or net value of life company with respect to policies or contracts

Section 9. 1. The commissioner shall each year compute, or cause to be computed, the reserve liability or net value on December thirty-first of the preceding year of every life company authorized to transact business in the commonwealth with respect to the policies or contracts hereinafter described in this subdivision and issued by such company prior to January first, nineteen hundred and forty-eight, in accordance with the following rules:

First, The net value of all outstanding policies of life insurance issued before January first, nineteen hundred and one, shall be computed upon the basis of the “Combined Experience” or “Actuaries’ of Table” of mortality, with interest at four per cent per annum.

Second, The net value of all outstanding policies of life insurance issued after December thirty-first, nineteen hundred, shall be computed upon the basis of the “American Experience Table” of mortality, with interest at three and one-half per cent per annum; but any life company may at any time elect to have the net value of such policies computed with interest at three per cent or two and one-half per cent and thereupon the net value of said policies shall be computed upon the basis of the “American Experience Table” of mortality, with interest at three per cent or two and one-half per cent per annum, as the case may be, and any life company receiving premiums by weekly payments may elect to have the net value of such weekly payment business or any portion thereof computed upon any table showing a higher rate of mortality approved by the commissioner.

Third, The net value of all outstanding total and permanent disability provisions incorporated in, or supplementary to, policies or contracts shall be computed on the basis of “Hunter’s Disability Table”, or any similar table approved by the commissioner, with interest not exceeding three and one-half per cent per annum; provided, that in no case shall said net value be less than one-half of the net annual premium computed on such table for the disability benefit.

Fourth, Except as otherwise provided in paragraph (b) of subdivision 2, the net value of all outstanding annuity contracts and of all contracts issued as pure endowments shall be computed on the basis of “McClintock’s Tables of Mortality among Annuitants” or on such higher table as the commissioner may prescribe, with interest at not more than five per cent per annum for group annuity and pure endowment contracts and not more than four per cent per annum for individual annuity and pure endowment contracts; provided, that annuities issued prior to January first, nineteen hundred and seven, and annuities deferred ten or more years and written in connection with life, endowment or term insurance shall be valued on the same mortality table from which the consideration or premiums were computed.

Fifth, The net value of all outstanding group life policies written as yearly renewable term insurance shall be computed on a basis not lower than the “American Men Mortality Table”, with interest at not more than three and one-half per cent per annum.

Sixth, Such tables or other bases as the commissioner approves shall be used for any kind of annuity, pure endowment, or insurance benefit or option, including without limitation any accident or sickness benefit, which the company is authorized to write and for the valuation of which specific provision is not made in this subdivision.

The net value of any class or classes of policies or contracts described in this subdivision may be computed, at the option of the company, on any basis which produces aggregate reserves for such class or classes greater than those computed in accordance with the foregoing rules.

2. The commissioner shall each year compute, or cause to be computed, the reserve liability or net value on December thirty-first of the preceding year of every life company authorized to transact business in the commonwealth with respect to the policies or contracts hereinafter described in this subdivision and issued by such company on and after January first, nineteen hundred and forty-eight, so that such reserve liability shall be at least equal to the amount computed in accordance with the minimum standard prescribed in this subdivision.

(a) Except as otherwise provided in paragraph (b) and subdivision 2A, the minimum standard of valuation shall be the commissioners reserve valuation methods, as defined in subdivisions 3, 3A and 6, interest at five per cent per annum for group annuity and pure endowment contracts and three and one-half per cent per annum for all other policies, and contracts or in the case of policies and contracts, other than annuity and pure endowment contracts, issued on or after March sixth, nineteen hundred and seventy-four, interest at four per cent per annum for such policies issued prior to December first, nineteen hundred and seventy-nine and interest at four and one-half per cent per annum for policies issued on or after December first, nineteen hundred and seventy-nine, and tables of mortality hereinafter specified.

First, For all ordinary policies of life insurance issued on the standard basis, excluding any total and permanent disability and accidental death benefits in such policies, the “Commissioners 1941 Standard Ordinary Mortality Table” shall be used for such policies issued prior to January first, nineteen hundred and sixty-six, and the “Commissioners 1958 Standard Ordinary Mortality Table” shall be used for such policies issued on or after said date and prior to the operative date of subdivision 6A of section 144; provided, that for any category of such policies issued on female risks all modified net premiums and present values referred to in this section may be calculated according to an age not more than six years younger than the actual age of the insured; and for such policies issued on or after the operative date of subdivision 6A of section one hundred and forty-four (i) the “Commissioners 1980 Standard Ordinary Mortality Table”, or (ii) at the election of the company for any one or more specified plans of life insurance, the “Commissioners 1980 Standard Ordinary Mortality Table with Ten-Year Select Mortality Factors”, or (iii) any ordinary mortality table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the Commissioner for use in determining the minimum standard of valuation for such policies.

Second, For all industrial life insurance policies issued on the standard basis, excluding any total and permanent disability and accidental death benefits in such policies, the “1941 Standard Industrial Mortality Table” shall be used for such policies issued prior to January first, nineteen hundred and sixty-eight and the Commissioners 1961 Standard Industrial Mortality Table shall be used for such policies issued on or after said date the “Commissioners 1961 Standard Industrial Mortality Table” or any industrial mortality table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such policies.

Third, For individual annuity and pure endowment contracts, excluding any total and permanent disability and accidental death benefits in such policies, the “1937 Standard Annuity Mortality Table” or, at the option of the company, the “Annuity Mortality Table for 1949, Ultimate” or any modification of either of these tables approved by the commissioner; provided, however, that for any contract issued on or after January 1, 2009, a mortality table shall only be applied to an individual or group annuity or pure endowment contract on a gender-neutral or gender-blended so-called basis in accordance with regulations promulgated by the commissioner.

Fourth, For group annuity and pure endowment contracts, excluding any total and permanent disability and accidental death benefits in such policies, the “Group Annuity Mortality Table for 1951”, any modification of such table approved by the commissioner, or, at the option of the company, any of the tables or modifications of tables specified for individual annuity and pure endowment contracts; provided, however, that for any contract issued on or after January 1, 2009, a mortality table shall only be applied to an individual or group annuity or pure endowment contract on a gender-neutral or gender-blended so-called basis in accordance with regulations promulgated by the commissioner.

Fifth, For total and permanent disability benefits incorporated in, or supplementary to, ordinary policies or contracts, for policies or contracts issued on or after January first, nineteen hundred and sixty-six, the tables of “Period 2 Disablement Rates and the 1930 to 1950 Termination Rates of the 1952 Disability Study of the Society of Actuaries”, with due regard to the type of benefit or any tables of disablement rates and termination rates, adopted after 1980 by the National Association of Insurance Commissioners, that are approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such policies; for policies or contracts issued on or after January first, nineteen hundred and sixty-one, and prior to January first, nineteen hundred and sixty-six, either such tables or, at the option of the company, the “Class (3) Disability Table (1926)”; and for policies or contracts issued prior to January first, nineteen hundred and sixty-one, the “Class (3) Disability Table (1926)”. Any such table shall, for active lives, be combined with a mortality table permitted for calculating the reserves for life insurance policies.

Sixth, For accidental death benefits in, or supplementary to, all policies, for policies issued on or after January first, nineteen hundred and sixty-six, the “1959 Accidental Death Benefits Table” or any accidental death benefits table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such policies; for policies issued on or after January first, nineteen hundred and sixty-one, and prior to January first, nineteen hundred and sixty-six, either such table or, at the option of the company, the “Inter-Company Double Indemnity Mortality Table”; and for policies issued prior to January first, nineteen hundred and sixty-one, the “Inter-Company Double Indemnity Mortality Table”. Either table shall be combined with a mortality table permitted for calculating the reserves for life insurance policies.

Seventh, Such tables or other bases as the commissioner approves shall be used for all outstanding group life policies, policies of life insurance issued on the substandard basis and any kind of annuity, pure endowment or insurance benefit or option, including without limitation any accident or sickness benefit, which the company is authorized to write and for the valuation of which specific provision is not made in this subdivision.

(b) Except as provided in subdivision 2A, the minimum standard for the valuation of all individual annuity and pure endowment contracts issued on or after January first, nineteen hundred and seventy-nine, and for all annuities and pure endowments purchased on or after such date under group annuity and pure endowment contracts, shall be the Commissioner’s Reserve Valuation Methods, as defined in subdivisions 3 and 3A, and the tables of mortality and interest rates hereinafter specified; provided, however, that for any contract issued on or after January 1, 2009, a mortality table shall only be applied to an individual or group annuity or pure endowment contract on a gender-neutral or gender-blended so-called basis in accordance with regulations promulgated by the commissioner.

First, for individual annuity and pure endowment contracts issued prior to December first, nineteen hundred and seventy-nine, excluding any disability and accidental death benefits in such contracts, the “1971 Individual Annuity Mortality Table”, or any modification of this table approved by the commissioner, and six per cent interest per annum for single premium immediate annuity contracts, and four per cent interest per annum for all other individual annuity and pure endowment contracts.

Second, for individual single premium immediate annuity contracts issued on or after December first, nineteen hundred and seventy-nine, excluding any disability and accidental benefits in such contracts, the “1971 Individual Annuity Mortality Table” or any individual annuity mortality table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such contracts, or any modification of these tables approved by the commissioner, and seven and one-half per cent interest per annum.

Third, for individual annuity and pure endowment contracts issued on or after December first, nineteen hundred and seventy-nine other than single premium immediate annuity contracts, excluding any disability and accidental death benefits in such contracts the “1971 Individual Annuity Mortality Table” or any individual annuity mortality table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such contracts, or any modification of these tables approved by the commissioner, and five and one-half per cent interest per annum for single premium deferred annuity and pure endowment contracts and four and one-half per cent interest per annum for all other such individual annuity and pure endowment contracts.

Fourth, for all annuities and pure endowments purchased prior to December first, nineteen hundred and seventy-nine, under group annuity and pure endowment contracts, excluding any disability and accidental death benefits purchased under such contracts the “1971 Group Annuity Mortality Table”, or any modification of this table approved by the commissioner, and six per cent interest per annum.

Fifth, for all annuities and pure endowments purchased on or after December first, nineteen hundred and seventy-nine, under group annuity and pure endowment contracts, excluding any disability and accidental death benefits purchased under such contracts, the “1971 Group Annuity Mortality Table” or any group annuity mortality table, adopted after 1980 by the National Association of Insurance Commissioners, that is approved by regulation promulgated by the commissioner for use in determining the minimum standard of valuation for such annuities and pure endowments, or any modification of these tables approved by the commissioner, and seven and one-half per cent interest per annum.

2A. (a) The interest rates used in determining the minimum standard for the valuation of:

(1) all life insurance policies issued in a particular calendar year, on or after the operative date of subdivision 6A of section one hundred and forty-four,

(2) all individual annuity and pure endowment contracts issued in a particular calendar year on or after January first, nineteen hundred and eighty-three,

(3) all annuities and pure endowments purchased in a particular calendar year on or after January first, nineteen hundred and eighty-three under group annuity and pure endowment contracts, and

(4) the net increase, if any, in a particular calendar year after January first, nineteen hundred and eighty-three, in amounts held under guaranteed interest contracts shall be the calendar year statutory valuation interest rates as defined in this subdivision.

(b) The calendar year statutory valuation interest rates, I, shall be determined as follows and the results rounded to the nearer one-quarter of one per cent:

(1) for life insurance,

I=.03+W (R1-.03)+W/2 (R2-.09);

(2) For single premium immediate annuities and for annuity benefits involving life contingencies arising from other annuities with cash settlement options and from guaranteed interest contracts with cash settlement options,

I =.03 + W (R -.03)

where R1 is the lesser of R and.09, R2 is the greater of R and.09, R is the reference interest rate defined in this subdivision, and W is the weighting factor defined in this subdivision,

(3) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, valued on an issue year basis, except as stated in clause (2), the formula for life insurance stated in clause (1) shall apply to annuities and guaranteed interest contracts with guarantee durations in excess of ten years and the formula for single premium immediate annuities stated in clause (2) shall apply to annuities and guaranteed interest contracts with guarantee duration of ten years or less,

(4) For other annuities with no cash settlement options and for guaranteed interest contracts with no cash settlement options, the formula for single premium immediate annuities stated in clause (2) shall apply.

(5) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, valued on a change in fund basis, the formula for single premium immediate annuities stated in clause (2) shall apply.

However, if the calendar year statutory valuation interest rate for any life insurance policies issued in any calendar year determined without reference to this sentence differs from the corresponding actual rate for similar policies issued in the immediately preceding calendar year by less than one-half of one per cent, the calendar year statutory valuation interest rate for such life insurance policies shall be equal to the corresponding actual rate for the immediately preceding calendar year. For purposes of applying the immediately preceding sentence, the calendar year statutory valuation interest rate for life insurance policies issued in a calendar year shall be determined for nineteen hundred and eighty, using the reference interest rate defined in nineteen hundred and seventy-nine, and shall be determined for each subsequent calendar year regardless of when subdivisions 6A of section one hundred and forty-four becomes operative.

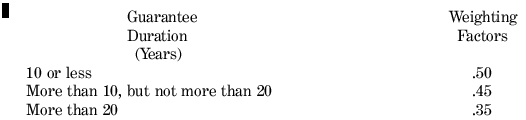

(c) The weighting factors referred to in the formulas stated above are given in the following tables:

(1) Weighting Factors for Life Insurance:

For life insurance, the guarantee duration is the maximum number of years the life insurance can remain in force on a basis guaranteed in the policy or under options to convert to plans of life insurance with premium rates or nonforfeiture values or both which are guaranteed in the original policy;

(2) Weighting factor for single premium immediate annuities and for annuity benefits involving life contingencies arising from other annuities with cash settlement options and guaranteed interest contracts with cash settlement options:

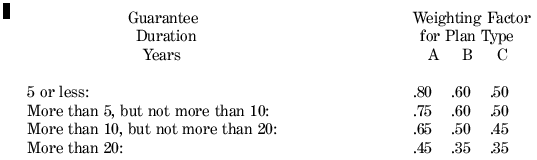

.80

(3) Weighting factors for other annuities and for guaranteed interest contracts, except as stated in clause (2), shall be as specified in tables (i), (ii), and (iii), according the rules and definitions in (iv), (v) and (vi):

(i) For annuities and guaranteed interest contracts valued on an issue year basis:

(iv) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, the guarantee duration is the number of years for which the contract guarantees interest rates in excess of the calendar year statutory valuation interest rate for life insurance policies with guarantee duration in excess of twenty years. For other annuities with no cash settlement options and for guaranteed interest contracts with no cash settlement options, the guarantee duration is the number of years from the date of issue or date of purchase to the date annuity benefits are scheduled to commence.

(v) Plan type as used in the above tables is defined as follows:

Plan Type A: At any time policyholder may withdraw funds only (1) with an adjustment to reflect changes in interest rates or asset values since receipt of the funds by the insurance company, or (2) without such adjustment but in installments over five years or more, or (3) as an immediate life annuity, or (4) no withdrawal permitted.

Plan Type B: Before expiration of the interest rate guarantee, policyholder may withdraw funds only (1) with an adjustment to reflect changes in interest rates or asset values since receipt of the funds by the insurance company, or (2) without such adjustment but in installments over five years or more, or (3) no withdrawal permitted. At the end of interest rate guarantee, funds may be withdrawn without such adjustment in a single sum or installments over less than five years.

Plan Type C: Policyholder may withdraw funds before expiration of interest rate guarantee in a single sum or installments over less than five years either (1) without adjustment to reflect changes in interest rates or asset values since receipt of the funds by the insurance company, or (2) subject only to a fixed surrender charge stipulated in the contract as a percentage of the fund.

(vi) A company may elect to value guaranteed interest contracts with cash settlement options and annuities with cash settlement options on either an issue year basis or on a change in fund basis. Guaranteed interest contracts with no cash settlement options and other annuities with no cash settlement options must be valued on an issue year basis. As used in this subdivision, an issue year basis of valuation refers to a valuation basis under which the interest rate used to determine the minimum valuation standard for the entire duration of the annuity or guaranteed interest contract is the calendar year valuation interest rate for the year of issue or year of purchase of the annuity or guaranteed interest contract, and the change in fund basis of valuation refers to a valuation basis under which the interest rate used to determine the minimum valuation standard applicable to each change in the fund held under the annuity or guaranteed interest contract is the calendar year valuation interest rate for the year of the change in the fund.

(d) The Reference Interest Rate referred to in paragraph (b) of this subdivision shall be defined as follows:

(1) For all life insurance, the lesser of the average over a period of thirty-six months and the average over a period of twelve months, ending on June thirtieth of the calendar year next preceding the year of issue, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(2) For single premium immediate annuities and for annuity benefits involving life contingencies arising from other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, the average over a period of twelve months, ending on June thirtieth of the calendar year of issue or year of purchase, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(3) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, valued on a year of issue basis, except as stated in paragraph (2), with guarantee duration in excess of ten years, the lesser of the average over a period of thirty-six months and the average over a period of twelve months, ending on June thirtieth of the calendar year of issue or purchase, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(4) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, valued on a year of issue basis, except as stated in paragraph (2), with guarantee duration of ten years or less, the average over a period of twelve months, ending on June thirtieth of the calendar year of issue or purchase, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(5) For other annuities with no cash settlement options and for guaranteed interest contracts with no cash settlement options, the average over a period of twelve months, ending on June thirtieth of the calendar year of issue or purchase, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(6) For other annuities with cash settlement options and guaranteed interest contracts with cash settlement options, valued on a change in fund basis, except as stated in paragraph (2), the average over a period of twelve months, ending on June thirtieth of the calendar year of the change in the fund, of Moody’s Corporate Bond Yield Average—Monthly Average Corporates, as published by Moody’s Investors Service, Inc.

(e) In the event that Moody’s Corporate Bond Yield Average—Monthly Average Corporates is no longer published by Moody’s Investors Service, Inc., or in the event that the National Association of Insurance Commissioners determines that Moody’s Corporate Bond Yield Average—Monthly Average Corporates as published by Moody’s Investors Service, Inc. is no longer appropriate for the determination of the reference interest rate, then an alternative method for determination of the reference interest rate, which is adopted by the National Association of Insurance Commissioners and approved by regulation promulgated by the commissioner, may be substituted.

3. Except as otherwise provided in subdivisions 3A and 6, the net value of the life insurance and endowment benefits of policies, referred to in subdivision 2, providing for a uniform amount of insurance and requiring the payment of uniform premiums, shall be the excess, if any, of the present value, at the date of valuation, of such future guaranteed benefits provided for by such policies, over the then present value of any future modified net premiums therefor. The modified net premiums for any such policy shall be such uniform percentage of the respective contract premiums for such benefits that the present value, at the date of issue of the policy, of all such modified net premiums shall be equal to the sum of the then present value of such benefits provided for by the policy and the excess of (a) over (b), as follows:

(a) a net level annual premium equal to the present value, at the date of issue, of such benefits provided for after the first policy year, divided by the present value, at the date of issue, of an annuity of one per annum payable on the first and each subsequent anniversary of such policy on which a premium falls due; provided, that such net level annual premium shall not exceed the net level annual premium on the nineteen year premium whole life plan for insurance of the same amount at an age one year higher than the age at issue of such policy, over.

(b) a net one year term premium for such benefits provided for in the first policy year.

Provided that for any life insurance policy issued on or after January first, nineteen hundred and eighty-six for which the contract premium in the first policy year exceeds that of the second year and for which no comparable additional benefit is provided in the first year for such excess and which provides an endowment benefit or a cash surrender value or a combination thereof in an amount greater than such excess premium, the reserve according to the commissioners reserve valuation method as of any policy anniversary occurring on or before the assumed ending date defined herein as the first policy anniversary on which the sum of any endowment benefit and any cash surrender value then available is greater than such excess premium shall, except as otherwise provided in subdivision 6, be the greater of the reserve as of such policy anniversary calculated as described in the preceding paragraph and the reserve as of such policy anniversary calculated as described in that paragraph, but with (i) the value defined in clause (a) of that paragraph being reduced by fifteen per cent of the amount of such excess first year premium, (ii) all present values of benefits and premiums being determined without reference to premiums or benefits provided for by the policy after the assumed ending date, (iii) the policy being assumed to mature on such date as an endowment, and (iv) the cash surrender value provided on such date being considered as an endowment benefit. In making the above comparison the mortality and interest bases stated in subdivisions 2 and 2A shall be used.

The net value of (a) policies of life insurance providing for a varying amount of insurance or requiring the payment of varying premiums (b) group annuity and pure endowment contracts purchased under a retirement plan or plan of deferred compensation, established or maintained by an employer, including a partnership or sole proprietorship, or by an employee organization, or by both, other than a plan providing individual retirement accounts or individual retirement annuities under section 408 of the Internal Revenue Code, (c) provisions for total and permanent disability or for accidental death benefits in, or supplementary to, all policies and contracts, and (d) provisions for any other insurance benefits, except life insurance and endowment benefits in life insurance policies and benefits provided by all other annuity and pure endowment contracts, shall be computed by a method consistent with the principles of the first paragraph of this subdivision, except that any extra premiums charged because of impairments or special hazards shall be disregarded in the determination of modified net premiums.

3A. This subdivision shall apply to all annuity and pure endowment contracts other than group annuity and pure endowment contracts purchased under a retirement plan or plan of deferred compensation, established or maintained by an employer, including a partnership or sole proprietorship, or by an employee organization, or by both, other than a plan providing individual retirement accounts or individual retirement annuities under Section 408 of the Internal Revenue Code.

Reserves according to the Commissioners Annuity Reserve Method for benefits under annuity or pure endowment contracts, excluding any disability and accidental death benefits in such contracts, shall be the greatest of the respective excesses of the present values, at the date of valuation, of the future guaranteed benefits, including guaranteed nonforfeiture benefits, provided for by such contracts at the end of each respective contract year, over the present value, at the date of valuation, of any future valuation considerations derived from future gross considerations, required by the terms of such contract, that become payable prior to the end of such respective contract year. The future guaranteed benefits shall be determined by using the mortality table, if any, and the interest rate, or rates, specified in such contracts for determining guaranteed benefits. The valuation considerations are the portions of the respective gross considerations applied under the terms of such contracts to determine nonforfeiture values.

4. The aggregate net value of all life insurance policies, excluding total and permanent disability and accidental death benefits, described in subdivision 2, shall in no case be less than the aggregate net value computed in accordance with the Commissioners Reserve Valuation Methods, as defined in subdivisions 3, 3A, 6 and 7A and the mortality table or tables and the rate or rates of interests used in computing the nonforfeiture benefits under such policies.

In no event shall the aggregate net value for all policies, contracts and benefits be less than the aggregate net values determined by the qualified actuary to be necessary to render the opinion required by section nine B.

The net value of any class or classes of policies or contracts described in subdivision 2, established by the commissioner, may be computed, at the option of the company, on any basis which produces aggregate reserves for such class or classes greater than those computed according to the minimum standard prescribed by subdivision 2; provided, that the rate or rates of interest used for policies and contracts, other than annuity and pure endowment contracts, shall not be higher than the corresponding rate or rates used on computing any nonforfeiture benefits thereunder.

5. Any company which at any time has adopted any basis of valuation for any class or classes of policies or contracts or for any benefit or option, whether or not specific provision is made therefor in subdivision 1 or 2, shall not thereafter adopt, without the approval of the commissioner, any basis of valuation producing lower reserves for such class or classes or for such benefit or option; provided, however, that for the purposes of this subdivision, the holding of additional reserves previously determined by a qualified actuary to be necessary to render the opinion required by section nine B shall not be deemed to be the adoption of a higher standard of valuation.

6. If, in the case that in any contract year the gross premium charged on any life policy or annuity or pure endowment contract, described in this section, is less than the valuation net premium therefor calculated by the method used in computing the net value thereof but using the minimum valuation standards of mortality and rate of interest, the minimum reserve required for such policy or contract shall be the greater of either the reserve calculated according to the mortality table, rate of interest, and method actually used for such policy or contract, or the reserve calculated by the method actually used for such policy or contract but using the minimum valuation standards of mortality and rate of interest and replacing the valuation net premium by the actual gross premium in each contract year for which the valuation net premium exceeds the actual gross premium. The minimum valuation standards of mortality and rate of interest referred to in this subdivision 6 are those standards stated in subdivisions 2 and 2A.

Provided that for any life insurance policy issued on or after January first, nineteen hundred and eighty-six for which the gross premium in the first policy year exceeds that of the second year and for which no comparable additional benefit is provided in the first year for such excess and which provides an endowment benefit or a cash surrender value or a combination thereof in an amount greater than such excess premium, the foregoing provisions of this subdivision 6 shall be applied as if the method actually used in calculating the reserve for such policy were the method described in subdivision 3, ignoring the second paragraph of subdivision 3. The minimum reserve at each policy anniversary of such a policy shall be the greater of the minimum reserve calculated in accordance with subdivision 3, including the second paragraph of that subdivision, and the minimum reserve calculated in accordance with this subdivision 6.

7. When the commissioner is satisfied that the risks which a company has assumed under policies or contracts referred to in subdivision 1 cannot be properly measured by the mortality tables specified in said subdivision, he may compute such additional reserve as in his judgment is warranted by the extra hazard assumed, and he may further in his discretion prescribe such table or tables of mortality as he may deem necessary properly to measure such additional risks with interest at not greater than four and one-half per cent per annum, for the computation of the net value of any special class or classes of risks.

7A. In the case of any plan of life insurance which provides for future premium determination, the amounts of which are to be determined by the insurance company based on then estimates of future experience, or in the case of any plan of life insurance or annuity which is of such a nature that the minimum reserves cannot be determined by the methods described in subdivisions 3, 3A and 6, the reserves which are held under any such plan must:

(a) be appropriate in relation to the benefits and the pattern of premiums for that plan, and

(b) be computed by a method which is consistent with the principles of this Standard Valuation Law, as determined by regulations promulgated by the commissioner.

8. The commissioner may use, or may accept use of, group methods and approximate averages for fractions of a year, or other reasonable approximations, and may accept computations made by the company if the commissioner is satisfied that such computations are accurate, in computing the reserve liability of a company made under this section. Such computation in the case of a company of a foreign country shall be limited to its United States business.

9. The reserve liability of a company shall include all liabilities of the company for the fulfillment of future unaccrued claims of policyholders, contract holders and beneficiaries arising from any kind of policy or contract which the company is authorized to write. To provide for such reserve liability, which shall be computed in accordance with the requirements of this section, the company shall hold funds in an amount equal thereto above all its other liabilities.

10. The commissioner shall issue, upon payment of the fee prescribed by section fourteen, a certificate in such form as he may prescribe, setting forth the amount of the entire reserve liability of a company, and specifying the bases and the methods, whether the net level premium or other method, which is used in the computation of said amount.

11. The commissioner may, in place of the computation of the reserve liability of a foreign life company required by this section, accept the certificate of valuation of the official having supervision over insurance companies in the state or other jurisdiction where the company is incorporated; provided, that such valuation is made in accordance with the requirements of this section or produces an aggregate net value at least as great as if made in accordance therewith; and provided, further, that such official is authorized to accept a similar certificate of the reserve liability of a domestic life company issued by the commissioner.

12. All policies of life insurance issued before July first, eighteen hundred and ninety-nine, by corporations formerly transacting a life insurance business on the assessment plan under chapter four hundred and twenty-one of the acts of eighteen hundred and ninety and acts in amendment thereof, and now having authority to do business in the commonwealth under this chapter, which policies are in force on December thirty-first of any year, and which contain a provision for a payment other than the premium stipulated therein, and under which the duration of the premium payment is the same as the duration of the contract, except in endowment policies, shall be valued and shall have a reserve maintained thereon on the basis of renewable term insurance as fixed by attained age in accordance with this chapter. To the reserve liability determined as above the commissioner shall add the determinate contract reserve under any other policies issued by said corporations before said July first and remaining in force on December thirty-first of any year, and in the absence of such contract reserve shall value them as contracts providing similar benefits are to be valued under this chapter. But under no policy shall a greater aggregate reserve liability be charged than is otherwise required by this section. All policies of life insurance issued by any such corporation subsequent to July first, eighteen hundred and ninety-nine, including those which contain a provision for a payment other than the premiums specified therein, shall be valued and a reserve maintained thereon according to this section; but all such policies issued by said corporations prior to January first, nineteen hundred and six, shall be valued taking the first year as one year term insurance.

13. This section shall apply to all life companies authorized to do business in the commonwealth and to any domestic company taxed as a life insurance company under the federal Internal Revenue Code as now or hereafter in force.

The commissioner shall, pursuant to chapter thirty A, promulgate a regulation containing the minimum standards applicable to the valuation of accident and sickness plans.

14. The commissioner may designate 1 or more statistical agents to assist the commissioner and any authorized insurer to comply with this section and any rules or regulations promulgated under this section.

Section: Previous 4D 4E 5 6 7 8 8A 9 9A 9B 10 11 11A 12 12A NextLast modified: September 11, 2015