Tracy v. Wikoff, 1 Dall. 124, 1 U.S. 124 (Pa. 1785)

Tracy v. Wikoff.

In this cause the Chief Justice laid down the following rule in computing interest.

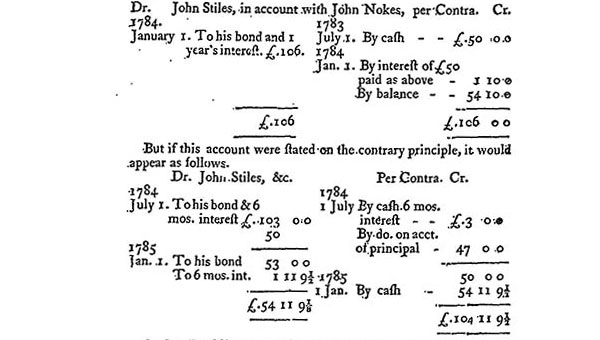

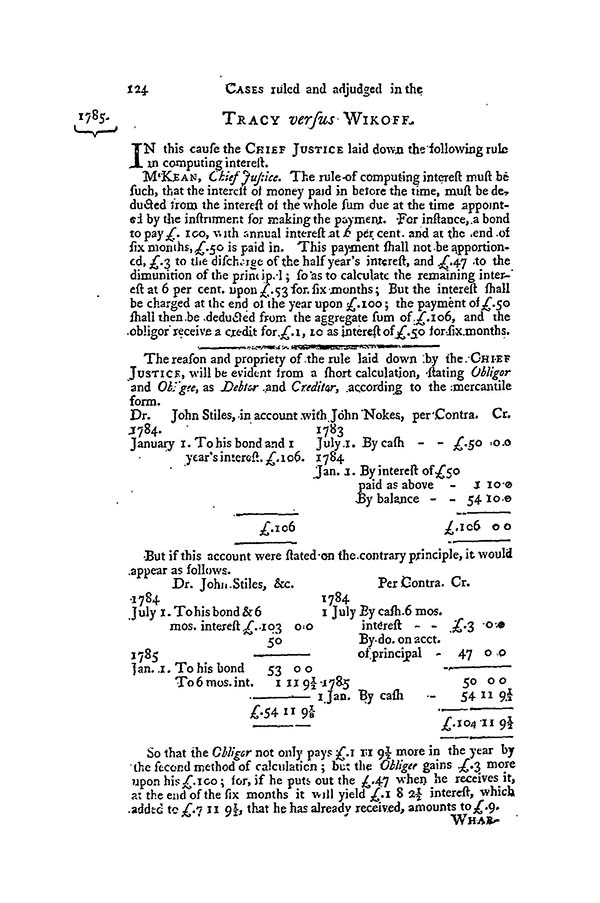

McKEAN, Chief Justice. The rule of computing interest must be such, that the interest of money paid in before the time, must be deducted from the interest of the whole sum due at the time appointed by the instrument for making the payment. For instance, a bond to pay £.100, with annual interest at 6 per cent and at the end of six months, £.50 is paid in. This payment shall not be apportioned, £.3 to the discharge of the half year's interest, and £.47 to the diminution of the principal; so as to calculate the remaining interest at 6 per cent, upon £.53 for six months; But the interest shall be charged at the end of the year upon £.100; the payment of £.50 shall then be deducted from the aggregate sum of £.106, and the obligor receive a credit for £.1, 10 as interest of £.50 for six months.

The reason and propriety of the rule laid down by the Chief Justice, will be evident from a short calculation, stating Obligor and Obligee, as Debtor and Creditor, according to the mercantile form.

Citation: Tracy v. Wikoff, 1 Dall. 124, 1 U.S. 124 (Pa. 1785)

Last modified: August 25, 2013